Imagine barreling down a highway in a fully loaded truck. The road is busy, the traffic unpredictable, and you’re carrying precious cargo. Now imagine realizing you have no brakes.

That’s what running a business without the right insurance, or without regularly reviewing your existing coverage, is like. You may not feel the danger yet. You may even be cruising along smoothly. But when an obstacle appears in your path, whether it’s an injury, a lawsuit, or an equipment failure, your ability to stop, pivot, or protect yourself is compromised. The result? Catastrophic.

At MartinoWest Business & Insurance Solutions, we’ve seen it too many times: good businesses are blindsided by preventable losses. Here’s what every business owner needs to understand about the importance of insurance and why putting it off is riskier than you think.

Here are five critical truths every business owner should understand before skipping coverage.

1. The Illusion of Control

“I’ve never had a claim.”

We hear this all the time, and it’s about as comforting as saying, “I’ve never crashed my car” while flying down a mountain road with no brakes. Past performance doesn’t guarantee future safety, especially in high-risk industries like construction, manufacturing, or logistics.

The truth is, you may be avoiding danger not because you’re invincible, but because you’ve been lucky. Relying on luck isn’t a strategy… it’s a gamble.

That’s where the concept of risk transfer comes in. Insurance doesn’t eliminate risk. It transfers the financial burden of that risk from your business to an insurer. When structured properly, this creates a cushion that allows you to recover quickly instead of absorbing the full impact of a claim or loss on your own.

Choosing to carry the risk yourself may feel like control, but it’s often an illusion. Real control comes from proactively protecting your business with a plan that’s built to absorb shock and keep you moving forward.

2. Hazards You Don’t See Coming

Every business faces hidden risks. Even a seemingly minor oversight or an unforeseen external event can trigger these challenges.

Some of the most common and costly include:

- Employee injuries on the job

- Slip-and-fall incidents involving clients or vendors

- Damage to tools, vehicles, or property

- Cyberattacks or data breaches

- HR and payroll compliance violations

Many of these events come out of nowhere. One bad day can undo years of hard work.

3. The True Cost of Going Without

Running a business without insurance might seem like a cost-cutting move at first glance. But skipping coverage can create a financial sinkhole.

For many small to medium businesses, just one significant uninsured loss can lead to bankruptcy or permanent closure.

Consider the real costs:

- Legal defense fees and settlements from lawsuits can quickly surpass six figures

- Natural disasters, vandalism, or theft can wipe out physical assets overnight

- Lost income from a business interruption can cripple your cash flow

- Cyberattacks can expose sensitive data and rack up steep penalties and recovery costs

And when it comes to employee injuries, without proper workers’ compensation coverage, you may be liable for everything from medical bills to lost wages and potential lawsuits.

Even minor incidents can balloon into major disruptions when you’re unprotected.

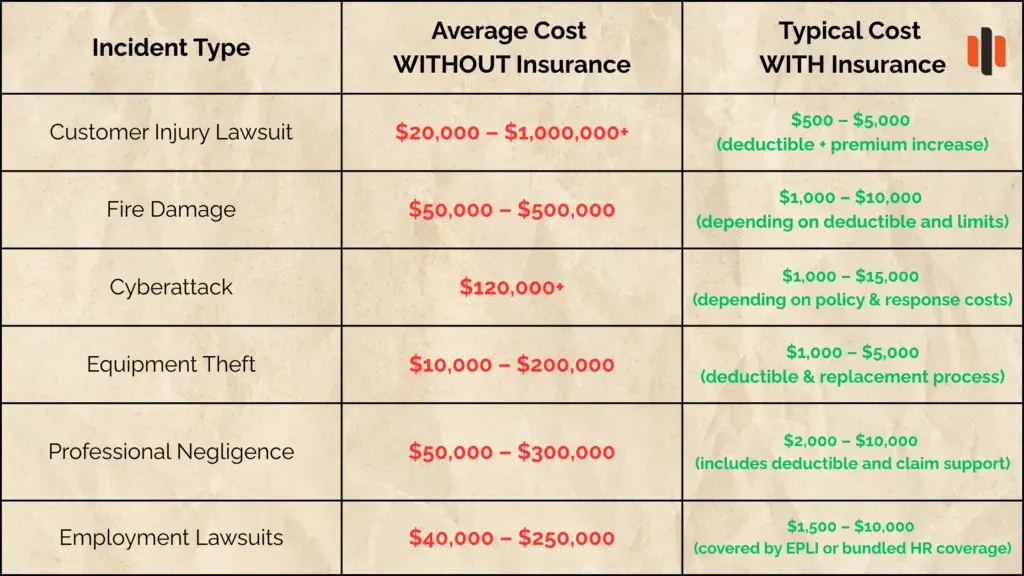

The Cost of Coverage vs. Catastrophe

Business insurance isn’t just a line item – it’s financial protection that can mean the difference between a quick recovery and closing your doors. While premiums and deductibles vary, they pale in comparison to the six- and seven-figure costs of going bare.

Here’s a general comparison:

*Note: All costs listed in the table above are general industry averages. Actual out-of-pocket expenses may vary significantly depending on your specific coverage, claim severity, and policy terms.

With MartinoWest’s help, coverage is tailored to your industry, risk level, and growth goals – so you only pay for what you need, and nothing you don’t.

4. Insurance Isn’t Just a Policy, It’s Your Business Safety System

Too many business owners treat insurance as an afterthought. But the right coverage is more than a document. It’s your emergency brake. It’s your seatbelt. It’s your traction control.

At MartinoWest, we help you:

- Identify hidden risks with personalized assessments

- Optimize coverage and eliminate overpayments

- Integrate insurance with HR, payroll, and compliance tools to create a true safety system for your company

We view insurance not just as a safety net, but as a strategic tool to keep your business running smoothly and competitively. Having proper coverage also boosts your credibility with clients, investors, and partners – showing that you’re a responsible, stable business prepared for the unexpected.

5. It’s Time to Pump the Brakes Before You Need to Slam Them

You don’t need to wait for a crash to realize your brakes were shot. Don’t let a preventable claim, audit, or fine be the moment you realize you’re unprotected.

We’re here to help you slow down, evaluate, and take back control before it’s too late.

Ready to find out if your insurance is doing its job?

Book a free risk review with MartinoWest Business & Insurance Solutions today. We’ll help you build the safety system your business deserves so you can protect, streamline, and grow with confidence!

Get a Qoute

Whether you need PEO support, business insurance, or streamlined payroll, we'll bundle the right solutions for your business. Get a personalized quote today.

Harper

Speak to Harper 24/7

Microphone ready

Start your custom insurance quote

Instant answers to your insurance questions

Schedule appointments or follow-ups

Professional Employer Organizations

Payroll, benefits, HR, workers' compensation, and compliance are seamlessly bundled through reliable PEO partners, empowering your business to achieve more with fewer resources.

Payroll+ Services

Payroll, HR, compliance, and back-office support are managed by a single team, allowing you to stop juggling multiple vendors and concentrate on driving growth.

Commercial Insurance

At MartinoWest, we craft comprehensive commercial coverage that protects your assets, employees, and bottom line without the corporate runaround.