For small businesses, size often feels like a disadvantage. You lack the buying power of big firms, the bench strength for complex compliance work, and the internal bandwidth to manage every HR need. It’s no wonder many small business owners feel stretched thin and outmatched.

That’s where associations have traditionally stepped in, offering small businesses collective strength, shared resources, and a voice. But there’s another, often-overlooked model that delivers many of the same advantages: the Professional Employer Organization (PEO) .

If you think of associations as a way to “act bigger” through community, a PEO is the HR and compliance version of that same idea.

The Power of Associations: Why Small Businesses Join

Before we dive into PEOs, let’s look at why businesses (especially smaller ones) join associations, chambers of commerce, and trade groups in the first place:

- Collective Influence : Associations advocate for their members. They fight regulatory battles, lobby for favorable legislation, and give smaller voices a seat at the table.

- Shared Knowledge & Learning : Whether it’s access to industry reports, expert panels, or certifications, associations help members stay informed and upskilled.

- Group Discounts & Resources : By pooling demand, associations can negotiate better rates on products, services, insurance, and software.

- Community, Networking & Support : Associations bring together like-minded professionals for events, mentorship, and problem-solving.

- Credibility & Visibility : Membership can signal trustworthiness and connect small firms with customers, partners, and peers.

In short: associations level the playing field. They give smaller organizations the scale and sophistication they couldn’t easily build alone.

Enter the PEO: Your “Association” for HR & Compliance

A Professional Employer Organization (PEO) might not host networking events or publish whitepapers, but in terms of real-world business operations, it delivers many of the same collective benefits.

When a small business joins a PEO, it enters into a co-employment relationship : the business still manages its team day-to-day, but the PEO becomes the “employer of record” for payroll, benefits, and compliance purposes. This shared structure unlocks big-business advantages.

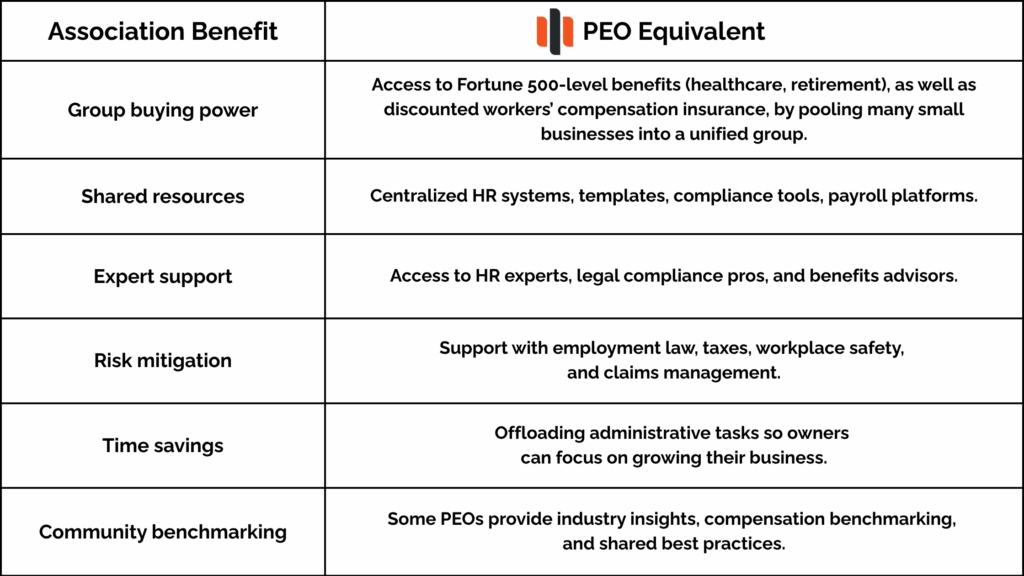

Here’s how it mirrors the association model:

PEOs as Business Support Systems: Built for Scale, Shared for Growth

While PEOs don’t replace traditional associations (and don’t engage in lobbying or industry-wide advocacy), they do act like a shared business services platform. In essence, a PEO is a member network of small employers who together enjoy:

- Lower costs — including reduced rates on benefits, payroll services, and workers’ compensation premiums through group coverage.

- Stronger compliance footing — with expert guidance on employment law, risk mitigation strategies, and regulatory changes to help avoid costly penalties.

- Scalable HR systems — offering access to modern payroll platforms, onboarding tools, and administrative support that grow with your business.

- Attractive employee benefits — such as healthcare, retirement plans, and wellness programs that help you compete with larger employers for top talent.

- Improved recruiting and retention — through enhanced HR support, streamlined processes, and more compelling compensation packages that keep your team engaged.

Much like a business association, a PEO gives small firms collective strength, shared resources, and access to tools they wouldn’t otherwise afford on their own.

Why This Matters Now More Than Ever

In 2025, businesses face complex challenges: tighter labor markets, rising benefit costs, evolving labor laws, and competitive pressure from larger firms. Small businesses need leverage, and both associations and PEOs offer it.

While your industry association might help you navigate policy or connect with peers, your PEO ensures your back office runs like a much bigger operation. Both models bring scale, strength, and systems that multiply what one small business can do alone.

The Bottom Line

A PEO isn’t just a vendor. It’s a partner that gives you access to shared power, the same way joining an association connects you to broader influence and support.

If you’re evaluating PEOs, look beyond the basics. Ask:

- What kind of benefits packages do they offer?

- How strong is their compliance support?

- Do they invest in shared resources, benchmarking, or client education?

- Can they scale as you grow?

At MartinoWest, we help small businesses not just select a PEO, but assess them the way you’d assess a top-tier association: looking at strength, transparency, and value for every “member.”

👉 Ready to explore how a PEO could work for you? Get in touch today and let’s talk about how you can use collective power to punch above your weight, just like the best associations do.

Get a Qoute

Whether you need PEO support, business insurance, or streamlined payroll, we'll bundle the right solutions for your business. Get a personalized quote today.

Harper

Speak to Harper 24/7

Microphone ready

Start your custom insurance quote

Instant answers to your insurance questions

Schedule appointments or follow-ups

Professional Employer Organizations

Payroll, benefits, HR, workers' compensation, and compliance are seamlessly bundled through reliable PEO partners, empowering your business to achieve more with fewer resources.

Payroll+ Services

Payroll, HR, compliance, and back-office support are managed by a single team, allowing you to stop juggling multiple vendors and concentrate on driving growth.

Commercial Insurance

At MartinoWest, we craft comprehensive commercial coverage that protects your assets, employees, and bottom line without the corporate runaround.